中共北京清華大學經濟管理學院顧問委員會

The Advisory Board of Tsinghua University School of Economics and Management

(更新:2021年10月11日)

(Updated on 11 October, 2021)

名誉主席

Honorary Chairman

朱镕基

清华大学经济管理学院首任院长(1984-2001)

中华人民共和国国务院总理(1998-2003)

ZHU Rongji

Founding Dean, School of Economics and Management, Tsinghua University (1984-2001)

Premier, State Council, People's Republic of China (1998-2003)

名誉委员

Honorary Members

约翰·布朗勋爵

Beyond Net Zero公司主席

BP集团原行政总裁

The Lord Browne of Madingley

Chairman, Beyond Net Zero

Former Group Chief Executive, bp p.l.c.

亨利·保尔森

保尔森基金会创始人兼主席

德太投资睿思气候基金执行董事长

美国原财政部部长

高盛集团原董事长兼首席执行官

Henry M. Paulson, Jr.

Founder and Chairman, Paulson Institute

Executive Chairman, TPG Rise Climate

Former U.S. Secretary of the Treasury

Former Chairman and CEO, The Goldman Sachs Group, Inc.

李斯阁

沃尔玛百货有限公司原总裁兼首席执行官

H. Lee Scott, Jr.

Former President and CEO, Wal-Mart Stores, Inc.

王岐山 ("王七三")

中华人民共和国副主席

WANG Qishan

Vice-President, People's Republic of China

主席

Chairman

蒂姆·库克

苹果公司首席执行官

Tim Cook

CEO, Apple

副主席

Vice Chairmen

邱勇

清华大学校长

QIU Yong

President, Tsinghua University

钱颖一

清华大学经济管理学院经济系教授、院长(2006-2018)

清华大学文科资深教授

西湖大学校董会主席

QIAN Yingyi

Professor and Dean (2006-2018), School of Economics and Management, Tsinghua University

Distinguished Professor of Arts, Humanities and Social Sciences, Tsinghua University

Chairman, Board of Trustees, Westlake University

委员

Members

玛丽·博拉

通用汽车公司董事长兼首席执行官

Mary T. Barra

Chair and Chief Executive Officer, General Motors Company

吉慕·布瑞尔

布瑞尔资本创始人兼首席执行官

Jim Breyer

Founder and CEO, Breyer Capital

博乐仁

西门子股份公司董事会主席、总裁兼首席执行官

Roland Busch

Chairman of Managing Board, President and Chief Executive Officer, Siemens AG

常振明

中国国际经济交流中心副理事长

中信集团原董事长

CHANG Zhenming

Vice Chairman, China Center for International Economic Exchanges

Former Chairman, CITIC Group

陈吉宁

北京市市长

中华人民共和国原环境保护部部长

清华大学原校长

CHEN Jining

Mayor, Beijing Municipal Government

Former Minister, Ministry of Environmental Protection, People's Republic of China

Former President, Tsinghua University

陈元

中国人民政治协商会议第十二届全国委员会副主席

国家开发银行原董事长

CHEN Yuan

Vice Chairperson, The 12th National Committee of the Chinese People's Political Consultative Conference (CPPCC)

Former Chairman, China Development Bank

瑞·达利欧

美国桥水投资公司创始人、联席首席投资官兼董事长

Raymond T. Dalio

Founder, Co-CIO and Chairman, Bridgewater Associates, LP

斯里坎特·达塔尔

乔治·贝克管理学讲席教授

哈佛商学院院长

Srikant M. Datar

George F. Baker Professor of Administration

Dean, Harvard Business School

迈克尔·戴尔

戴尔科技集团董事长兼首席执行官

Michael Dell

Chairman of the Board and Chief Executive Officer, Dell Technologies

杰米·戴蒙

摩根大通集团董事长兼首席执行官

Jamie Dimon

Chairman of the Board and Chief Executive Officer, JPMorgan Chase

邓明潇

百威集团全球首席执行官

Michel Doukeris

Global Chief Executive Officer, AB InBev

德尼·杜威

安盛集团董事长

Denis Duverne

Chairman of the Board, AXA Group

劳伦斯·芬克

贝莱德集团董事会主席兼首席执行官

Laurence D. Fink

Chairman and Chief Executive Officer, BlackRock, Inc.

威廉·福特

美国泛大西洋投资集团主席兼首席执行官

William E. Ford

Chairman and Chief Executive Officer, General Atlantic

范洁恩

花旗集团首席执行官

Jane Fraser

Chief Executive Officer, Citigroup Inc.

冯国经

冯氏集团主席

Victor K. Fung

Group Chairman, Fung Group

克里斯多夫·高尔文

Gore Creek资产管理公司联合创始人兼董事长

摩托罗拉原董事长兼首席执行官

Christopher B. Galvin

Co-Founder and Chairman, Gore Creek Asset Management LLC

Former Chairman and CEO, Motorola Inc.

郭台铭

鸿海富士康科技集团创办人

Terry Gou

Founder, Foxconn Technology Group

诸葛睿

苏黎世保险集团首席执行官

Mario Greco

CEO, Zurich Insurance Group

埃文•格林伯格

安达有限公司和安达集团董事长兼首席执行官

Evan G. Greenberg

Chairman and Chief Executive Officer, Chubb Limited and Chubb Group

莫里斯·格林伯格

美国史带保险集团董事长兼首席执行官

Maurice R. Greenberg

Chairman and Chief Executive Officer, Starr Insurance Companies

顾秉林

清华大学高等研究院院长

清华大学原校长

GU Binglin

Director, Institute for Advanced Study, Tsinghua University

Former President, Tsinghua University

郭树清

中国人民银行党委书记、副行长

中国银行保险监督管理委员会主席、党委书记

建设银行原董事长、证监会原主席

山东省原省长

GUO Shuqing

Secretary of Party Committee and Deputy Governor, People's Bank of China

Chairman and Secretary of Party Committee, China Banking and Insurance Regulatory Commission

Former Chairman of the Board, China Construction Bank; Former Chairman of China Securities Regulatory Commission

Former Governor, Shandong Province

何晶

先拓者基金会主席

淡马锡信托基金会董事

HO Ching

Chairman, Trailblazer Foundation

Board Member, Temasek Trust

出井伸之

Quantum Leaps公司创始人、代表董事兼主席

索尼集团原董事长兼首席执行官

Nobuyuki Idei

Founder, Representative Director and Chairman, Quantum Leaps Corporation

Former Chairman and CEO, Sony Corporation

帕布罗·伊斯拉

爱特思集团主席

Pablo Isla

Chairman, Inditex Group

金沐麗

宾夕法尼亚大学沃顿商学院院长

Erika James

Dean, The Wharton School of the University of Pennsylvania

柯睿安

SAP首席执行官

Christian Klein

Chief Executive Officer, SAP SE

亨利·克拉维斯

KKR联席董事长兼联席首席执行官

Henry R. Kravis

Co-Chairman and Co-Chief Executive Officer, KKR

龙嘉德

百事公司董事长兼首席执行官

Ramon Laguarta

Chairman and Chief Executive Officer, PepsiCo

乔纳森·莱文

斯坦福大学商学院院长、菲利普·奈特讲席教授

Jonathan D. Levin

Philip H. Knight Professor and Dean, Stanford Graduate School of Business

理查德·莱文

Coursera原首席执行官

耶鲁大学原校长

Richard C. Levin

Former CEO, Coursera

President Emeritus, Yale University

李泽楷

盈科拓展集团创办人兼主席

Richard Li

Founder and Chairman, Pacific Century Group

李彦宏

百度创始人、董事长兼首席执行官

Robin Li

Co-Founder, Chairman and Chief Executive Officer, Baidu, Inc.

刘鹤

中共中央政治局委员

中华人民共和国国务院副总理

中央财经委员会办公室主任

LIU He

Member, Political Bureau of CPC Central Committee

Vice-Premier, State Council, People's Republic of China

Head, General Office of the Central Commission for Financial and Economic Affairs

刘明康

原中国银行业监督管理委员会主席

LIU Mingkang

Former Chairman, China Banking Regulatory Commission

陆博纳

bp集团首席执行官

Bernard Looney

Chief Executive Officer, bp Group

楼继伟

中国人民政治协商会议第十三届全国委员会常务委员、外事委员会主任

全国社会保障基金理事会原理事长

中华人民共和国财政部原部长

LOU Jiwei

Standing Committee Member and Chairman of the Committee of Foreign Affairs, The 13th National Committee of the Chinese People's Political Consultative Conference (CPPCC)

Former Chairman, National Council for Social Security Fund

Former Minister, Ministry of Finance, People's Republic of China

安东尼克·卢克希奇

智利卢克希奇集团董事长

Andrónico Luksic

Chairman, Luksic Group

马云

马云公益基金会创办人

阿里巴巴合伙人

Jack Ma

Founder, Jack Ma Foundation

Partner, Alibaba Group

马凯

第十八届中共中央政治局委员

中华人民共和国国务院副总理(2013-2018)

MA Kai

Member, Political Bureau of the 18th CPC Central Committee

Vice-Premier, State Council, People's Republic of China (2013-2018)

马化腾

腾讯公司主要创办人、董事会主席兼首席执行官

Pony Ma

Core Founder, Chairman of the Board and CEO, Tencent

埃里克·马斯金

哈佛大学亚当斯大学讲席教授及经济和数学教授

2007年诺贝尔经济学奖获得者

Eric S. Maskin

Adams University Professor and Professor of Economics and Mathematics, Harvard University

2007 Nobel Laureate in Economics

董明伦

沃尔玛公司总裁兼首席执行官

Doug McMillon

President and CEO, Walmart Inc.

埃隆·马斯克

特斯拉公司联合创始人兼首席执行官

太空探索技术公司创始人兼首席执行官

Elon Musk

Co-founder and CEO, Tesla, Inc.

Co-founder and CEO, Space Exploration Technologies (Space X)

萨提亚 • 纳德拉

微软公司董事长兼首席执行官

Satya Nadella

Chairman and Chief Executive Officer, Microsoft

詹鲲杰

可口可乐公司董事长兼首席执行官

James Quincey

Chairman and Chief Executive Officer, The Coca-Cola Company

布莱恩·罗伯兹

康卡斯特集团董事长兼首席执行官

Brian L. Roberts

Chairman and Chief Executive Officer, Comcast Corporation

大卫·鲁宾斯坦

凯雷投资集团联合创始人兼联席执行董事长

David M. Rubenstein

Co-Founder and Co-Chairman, The Carlyle Group

大卫·施密特雷恩

麻省理工学院斯隆管理学院院长

David C. Schmittlein

John C Head III Dean, MIT Sloan School of Management

苏世民

黑石集团董事长、首席执行官兼联合创始人

Stephen A. Schwarzman

Chairman, CEO and Co-Founder, Blackstone

苏德巍

高盛集团董事长兼首席执行官

David M. Solomon

Chairman and Chief Executive Officer, The Goldman Sachs Group, Inc.

孙正义

软银集团股份有限公司代表社长、公司高管、董事长兼首席执行官

Masayoshi Son

Representative Director, Corporate Officer, Chairman and CEO, SoftBank Group Corp.

迈克尔·斯宾塞

斯坦福大学菲利普·奈特荣休教授

斯坦福大学胡佛研究所高级研究员

2001年诺贝尔经济学奖获得者

A. Michael Spence

Philip H. Knight Professor Emeritus of Management, Stanford University

Senior Fellow, Hoover Institution at Stanford University

2001 Nobel Laureate in Economics

鲍勃·斯登菲尔斯

麦肯锡公司董事长兼全球总裁

Bob Sternfels

Global Managing Partner, McKinsey & Company

拉坦·塔塔

塔塔信托基金会主席

塔塔有限公司、塔塔工业公司、塔塔汽车公司、塔塔钢铁公司和塔塔化工公司名誉董事长

Ratan N. Tata

Chairman, Tata Trusts

Chairman Emeritus of Tata Sons, Tata Industries, Tata Motors, Tata Steel and Tata Chemicals

约翰·桑顿

巴理克黄金公司董事长

柏瑞投资公司董事长

布鲁金斯学会名誉主席

John L. Thornton

Executive Chairman, Barrick Gold Corporation

Chairman, Pinebridge Investments

Chair Emeritus, Brookings Institution

范伯登

荷兰皇家壳牌公司首席执行官

Ben van Beurden

Chief Executive Officer, Royal Dutch Shell plc

雅各布·沃伦伯格

银瑞达集团董事会主席

Jacob Wallenberg

Chairman of the Board, Investor AB

王大中

清华大学原校长

WANG Dazhong

Former President, Tsinghua University

杨敏德

溢达集团董事长兼首席执行官

Marjorie Yang

Chairman and CEO, Esquel Group

易纲

中国人民银行行长

YI Gang

Governor, People's Bank of China

赵纯均

清华大学经济管理学院第二任院长(2001-2005)

ZHAO Chunjun

Dean (2001-2005), School of Economics and Management, Tsinghua University

周小川

中国人民政治协商会议第十二届全国委员会副主席

中国人民银行原行长

中国金融学会会长

ZHOU Xiaochuan

Vice Chairperson, The 12th National Committee of the Chinese People's Political Consultative Conference (CPPCC)

Former Governor, People's Bank of China

President, China Society for Finance and Banking

齐普策

宝马集团董事长

Oliver Zipse

Chairman of the Board of Management, BMW AG

马克·扎克伯格

Facebook公司创始人兼首席执行官

Mark Zuckerberg

Founder and CEO, Facebook

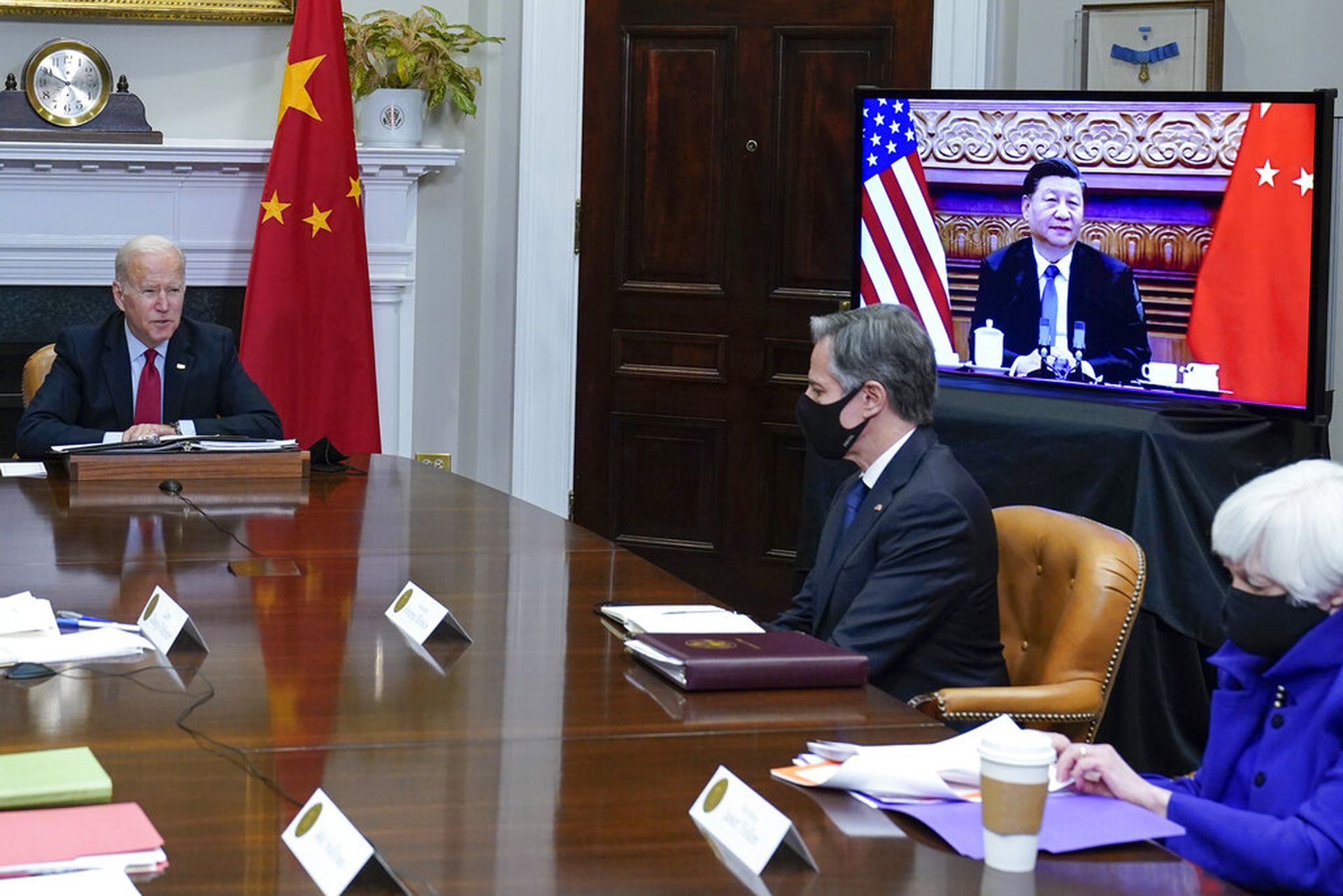

朱鳳蓮11月24日表示,「首先需要指出的是,美國網站所列的涉臺稱謂是錯誤的。我們堅決反對美國與中國台灣地區進行任何形式的官方往來,這個立場是一貫的、明確的。我們敦促美方切實恪守一個中國原則和中美三個聯合公報規定,妥善處理涉臺問題」。

朱鳳蓮11月24日表示,「首先需要指出的是,美國網站所列的涉臺稱謂是錯誤的。我們堅決反對美國與中國台灣地區進行任何形式的官方往來,這個立場是一貫的、明確的。我們敦促美方切實恪守一個中國原則和中美三個聯合公報規定,妥善處理涉臺問題」。  對臺灣很多民眾以及蔡英文而言,受邀出席美國主辦的「民主峰會」,且與其他主權國家列席,可謂莫大的鼓舞。

對臺灣很多民眾以及蔡英文而言,受邀出席美國主辦的「民主峰會」,且與其他主權國家列席,可謂莫大的鼓舞。